Today’s bankers have no shortage of headaches.

Agile “fintech” challengers, tech-savvy customers, complex compliance demands, legacy-burdened IT environments — all conspire to keep them up at night.

But there is great news for retail banks — as Cisco has outlined in a new research study, “A Roadmap to Digital Value in Retail Banking.”

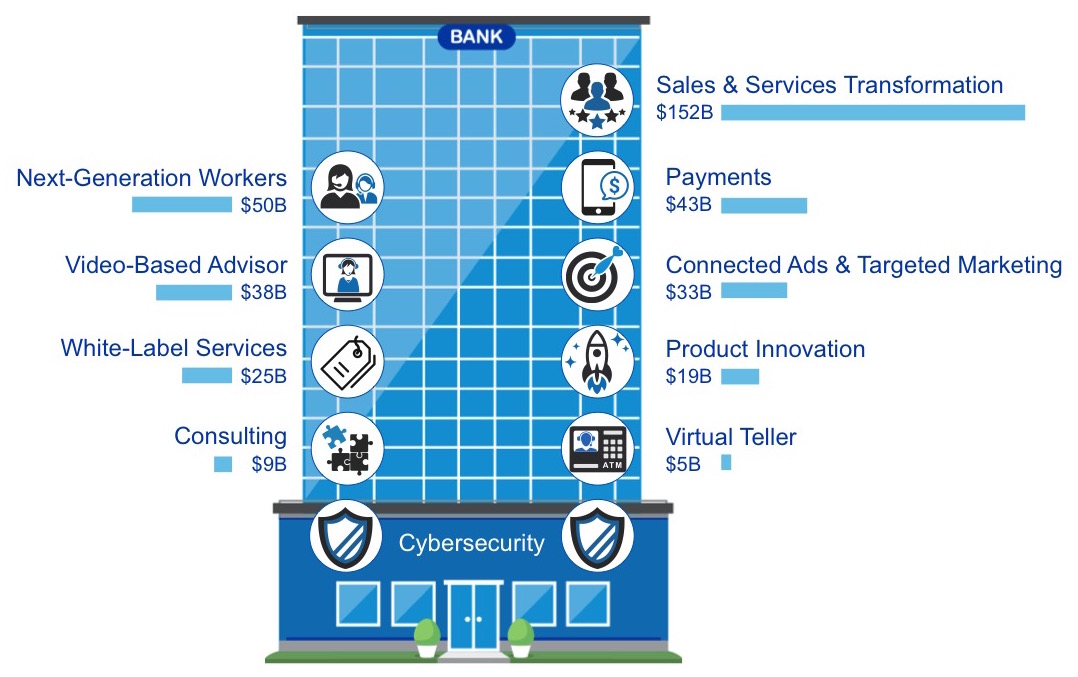

By adopting some key digital solutions (see Figure 1), retail banks can capture their share of an enormous opportunity: $405 billion in industrywide Digital Value at Stake from 2015-2017.

Banks need to act fast, however. As our report states, 41 percent of financial services executives believe that digital disruption increases their chances of going out of business. Yet, only 27 percent are actively responding by digitally disrupting their own businesses.

Change is always daunting. As Ray Davis, CEO of Umpqua Bank said, ‘how can banks differentiate? What do you do in this digital stage?’ To start this journey, banks can first focus on driving the savings and efficiencies that will support a self-funding model.

Next-generation workforce as Alyson Clarke said, one of the bank’s competitive advantages, can be empowered with real-time data insights and freed from tedious manual compliance tasks. This in turn can drive new levels of efficiency, productivity, and innovation. Those savings can then be reinvested. And new data insights can be leveraged.

Which is where the real fun begins.

That is, in creating the most compelling customer experience possible, across all channels.

Digital-enabled capabilities such as sales and services transformation (for example, digitizing the branch experience), video advice, virtual tellers, and mobile payments can vastly transform the customer experience. They create the kinds of relevant, personalized, and convenient offerings that customers expect.

Effective cybersecurity is the critical foundation of all of these use cases. Without it, your bank will lack the confidence to try exciting new digital solutions and experiences — and your customers will lack the trust to try them.

Financial institutions are built on customer trust. Banks must be able to prevent security breaches — and detect and remedy them quickly if they occur.

Rather than just a pure defensive strategy, cybersecurity can be a true differentiator that supports agility, innovation, and growth. That means companies need to begin viewing cybersecurity differently — beyond its traditional “defensive” role.

Challenges abound. But make no mistake—this is an exciting time for banks. It does not need to be a bumpy ride.

A secure, more fully digitized bank will be in position to drive its own disruption. Along the way, it will create new levels of innovation and customer loyalty—and as Ray Davis, CEO of Umpqua Bank put it, ‘you’ll have a lot of people trying to copy you.’

CONNECT WITH US