It’s evident that digital investments made prior to 2020 helped many financial institutions respond quickly to a rapidly changing operational environment. The “shift to digital”, necessitated by these changes, was largely confirmation of what institutions already understood about the future of customer engagement. Instead, the most useful insight is likely the remarkable agility demonstrated by the industry and how it changed executives’ perspectives of prior and future transformation strategies. The demonstration of speed has set expectations for faster transformations in the future, and a reinterpretation of prior efforts as lacking a true driver for speed.

Random House’s dictionary defines Transformation as, “the act or process of transforming” as well as, “the state of being transformed”. Arguably, the pervasiveness of digital inside financial services today is indicative of the latter. We have arrived at a state of digital transformation where hybrid work, enhanced collaboration, and the cloud are established enablers of the road ahead. A quote by Winston Churchill is an apt reflection of where we stand in 2022.

Put in context, this was referencing war. Nobody knew when the end would be, but the “end of the beginning” signaled a new phase of the campaign. As financial services look ahead, it is perhaps time to consider the next phase of the transformation campaign in pursuit of complete operational transformation as the end-goal.

Operational Transformation

Few would have predicted existing digital capabilities would scale as efficiently and effectively as they did in 2020. However, that scaling changed the future of customer and employee experience in less than two years. Consequently, financial services executives are more confident in their organization’s ability to accelerate transformation at scale. Institutions are investing in digital platforms and tools that will elevate the capabilities of a hybrid, agile workforce and lead to more efficient operating models. With each transformation of a business line, financial institutions are reducing complexity and removing operational constraints that hindered growth opportunities. Each success improves the potential of translating synergy between lines of business into truly differentiated customer and employee experiences. Institutions will reach a significant operational transformation milestone when this capability reaches critical mass across the business.

A modern digital infrastructure is needed to power the transformation of financial services, and institutions must strive to select the best solutions for this journey. However, managing the complexity of the IT estate is of equal importance, as IT operational constraints can slow transformation’s momentum. The key challenge is extracting insights from the vast amounts of operational data generated by IT systems to quickly remediate issues, optimize the infrastructure, and keep transformation on track.

AIOps – Artificial Intelligence for IT Operations

AIOps platforms are essential to a modern digital infrastructure. They enhance IT operations through analytics and machine learning (ML) to ensure consistently reliable, high-performing, and secure services. AIOps collects a variety of data from various IT operations tools and employs AI/ML analytics to automatically spot and react to issues in real-time.

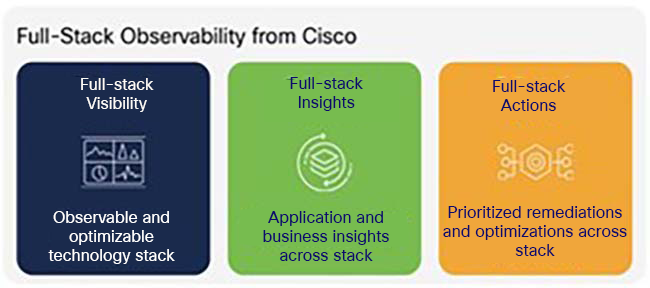

Cisco Full Stack Observability (FSO) enhances AIOps by consolidating visibility of the technology stack across operational domains. This enables a shared understanding across NetOps, DevOps, SecOps, and InfraOps teams leading to faster issue identification and resolution.

Cisco FSO also provides insights that correlate application and infrastructure performance to business KPI’s, giving business leaders a more relevant view of the impact when issues arise. Lastly, Cisco FSO utilizes collected intelligence about the infrastructure to make prioritized recommendations. These recommendations remediate issues as well as optimize the technology stack.

Summary

Financial institutions are clearly committed to continuing their transformation, as efficiency and agility are beneficial in all economic conditions. They must address operational constraints, including the need for better IT operational visibility, to keep moving forward with momentum.

Additional Resources

Cisco Full Stack Observability website

Full Stack Observability white paper by IDC

Customer Story – Freedom Financial

CONNECT WITH US