It is often said financial services businesses are built on relationships. The truth of this adage lies in the essentialness of financial needs and the role of trust in financial relationships. It’s a key reason why the existence of digital-only financial services has yet to cause the far-reaching disruption seen in other industries. Incumbent financial institutions continue to build trust- based relationships through the expertise of their financial professionals while pursuing digitization to optimize customer experience and improve operational efficiency.

The extreme circumstances of the COVID-19 pandemic do not appear to have changed the desire for financial relationships. A recent Cornerstone Advisors study conducted in Q2 2021 concluded that today’s consumers – including younger age groups – desire both human interactions and improved digital experiences in their financial lives.

The pandemic however raised consumer expectations of digital channels to new levels. Customers turned to on-line and mobile channels en masse only to find the capabilities and scope of offerings limited. Nevertheless, the pandemic proved to be a catalyst for digital financial services as there was clear evidence digital channels played a key role in the continuity of financial services. Their potential for delivering superb customer experiences and strengthening business resilience was an encouraging prospect amid changing operational conditions.

‘Digital-first engagement’ describes the mission of financial institutions seeking to make optimal use of digital channels as entry points to more meaningful customer experiences. With the addition of more services and capabilities over time, institutions will build a more efficient and resilient operating model for the future. Along this journey, institutions should focus on three guiding principles:

Focus on Convenience

Convenience is an intrinsic characteristic of digital that’s often associated with transactional activities like online bill pay and check deposit, proactive notifications like payment reminders and fraud alerts and, with increasing frequency, intelligent self-service capabilities.

Giving consumers more ways to initiate engagement for advice-based services is a prime example of convenience enabled by intelligent self-service. When the pandemic limited access to financial branches, innovative institutions leveraged appointment scheduling solutions on their web and mobile apps to provide customers with more options to book meetings with their financial advisors, including virtual meetings. The latter took advantage of workflow integrations with their Cisco Webex Meeting platform to automate the scheduling of meetings without human intervention. Notably, these experiences were as convenient and productive for employees as they were for customers.

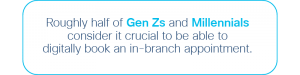

As Cornerstone’s study highlights, delivering meaningful self-service conveniences like appointment scheduling will be increasingly important to future generations of customers.

like appointment scheduling will be increasingly important to future generations of customers.

Integrate Human + Digital Experiences

Robust engagement capabilities on digital channels can reduce inefficient processes and communications that are often associated with the sale of more complex financial products. These capabilities will seamlessly integrate access to financial services professionals throughout the customer journey, providing greater convenience while satisfying customer desire for trust- based relationships.

Financial services consumer satisfaction studies by research firm JD Power consistently find that consumers desire more frequent communications and updates during their journeys. To achieve this, institutions need to integrate a range of communication tools into digital channels including AI-assisted chatbots, rich messaging and collaboration platforms, and omnichannel contact centers. When delivered consistently across products and services, these capabilities help digital channels strengthen brand value and preference.

Digitize Core Businesses End-to-End

In addition to digitizing core services like account opening and onboarding, financial institutions must do the heavy lifting to digitize core businesses like lending, wealth management, and insurance from end-to-end. These efforts often require investment in new cloud platforms from both traditional and fintech solution providers, which drove a notable increase in cloud spending in 2020.

With an established set of digital engagement tools, institutions will be able to integrate these capabilities into their orchestration and automation strategies for their core businesses from the very start. The result will be the ability to deliver personalized digital experiences across all core businesses, enabled by digital-first engagement capabilities that satisfy the aforementioned guiding principles of convenience and access to financial expertise.

Digital Engagement Platform

Financial institutions are relying on IT departments to provide a digital-first engagement platform that will meet the needs of the business today and into the future. More than ever, an integrated set of capabilities is needed to avoid the cost and time challenges of tying together a disparate collection of solutions. Business leaders require the ability today to design digital-first engagement into their future digital experiences. This is what drives Cisco’s mission to create an industry-leading customer journey platform to enable digital engagements. Consisting of world- class collaboration, messaging, and contact center technologies, we’re focused on providing an enterprise-class platform to power the future of financial services delivery.

We invite you to learn more at https://www.cisco.com/go/financialservices.

Sources:

Cornerstone Advisors: The Human+Digital Challenge in Banking https://www.crnrstone.com/research/commissioned-research/

JD Power Financial Services https://www.jdpower.com/business/financial-services

CONNECT WITH US