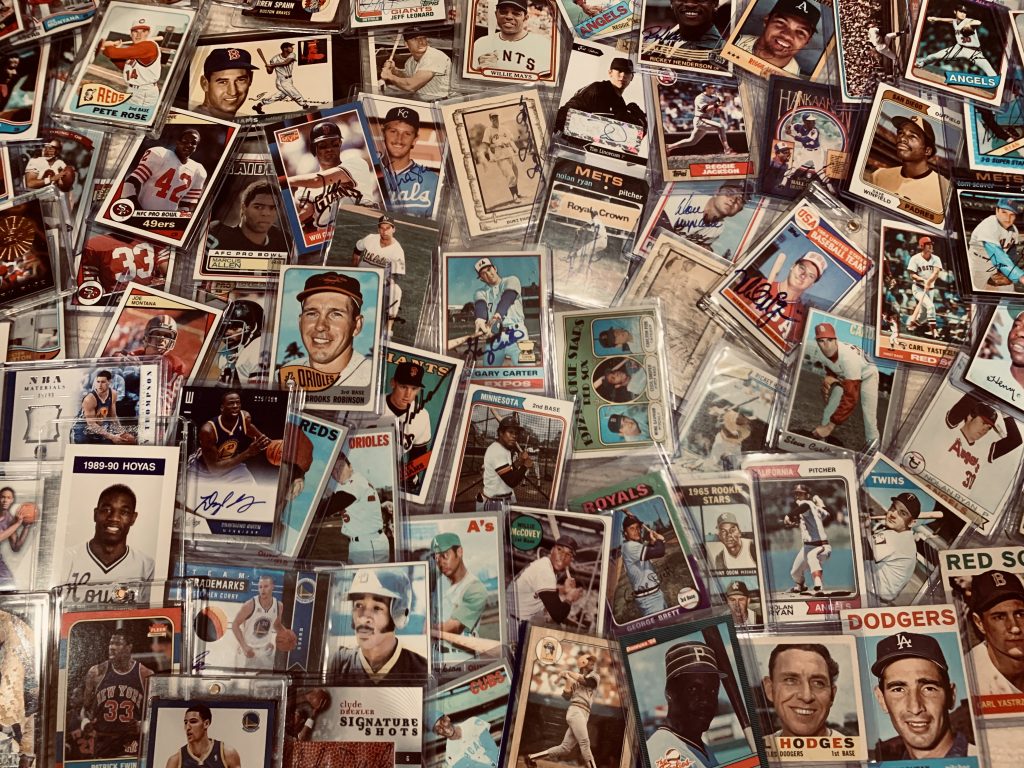

When I was a young kid, one of my absolute favorite hobbies was to collect and trade baseball cards. Back then, just about every cent I had went into that personal obsession. Analyzing player statistics, the thrill of negotiation, and satisfaction of a successful trade were all part of a fulfilling and formative youth experience. Fast forward to today, and I’m still a huge sports fan and casual memorabilia collector who has turned that love of data, analysis, prediction and negotiation into a career in investments, mergers and acquisitions.

Having recently been named the new SVP of Corporate Development and Cisco Investments, I feel I have the best job in the world – managing a team of domain experts, partnering with business unit leaders on strategy, and engaging with venture capitalists, investment banks, entrepreneurs and founders.

Since joining Cisco in 2007, I’ve had the opportunity to spearhead more than 30 deals valued at over $15 billion, including the acquisitions of Duo Security, Sourcefire, OpenDNS and Leaba Semiconductor. I can attest from personal experience that Cisco’s Corporate Development team is the best in the industry – we are structured to blend our M&A expertise together with a view as a corporate investor. Investments keep us close to the market and we use these insights to be strategic in our acquisitions. Our team stands at the cross section of the most important sectors of technology innovation – networking, security, collaboration, analytics and cloud – with access to top-level Cisco engineers and deep engagement within the startup ecosystem. We essentially are the professional scouts who search for new, bright talent to bring into the major leagues. This positions Cisco to leverage insights from multiple corners, so we are able to identify and capitalize on market disruptions and transitions.

My appointment as the leader of the team comes at an interesting point in time. The emergence of COVID-19 has upended our lives along with the global economy, leaving many of us in the industry to wonder how this will impact corporate investing and M&A. None of us really knows what’s next but my instinct is to follow the lessons I took away from trading sports cards…analyze the data, make strategic predictions and negotiate a fair deal. When pondering whether to write the check, corporate VCs should consider looking deeper at potential risk/reward ratios for investing. Entrepreneurs should lean into negotiations, optimizing for both long-term capital runway and trusted board and advisor support. Corporations should invest as much time on cultural fit as they do on financial modeling prior to acquiring an asset. There’s no doubt in my mind that we will eventually see an uptick in the market – just as we did after the dot-com bubble and the 2008 recession. I believe that those who readily take to the field – regardless of who’s in the stands – to proactively go after deals will reap the benefits.

Looking ahead, a key tenet for Cisco’s approach to M&A and investments will be this – consistency. Cisco has a rich history of embracing external innovation to the advantage of our customers and partners. We are proud of our nearly 30 years of M&A experience and 25 years of venture investing and that won’t change. We will continue to embrace the aspects I feel are most essential for any acquisition or investment – the potential for market and technology disruption, the talent of the team, and compatibility of the culture. Just as I learned as a kid trading cards, it’s the statistics on the back of the card – earned run averages, batting averages, etc. – that are key to projecting player performance and making a good trade. When I think about it, that’s not too different than my role today, helping think through our portfolio of assets and leading the deals that will position Cisco for profitable, long-term growth.

Interesting Derek….this is my interest area as well….analyzing data and making prediction….sometime will intersect ….

Love the story on how your passion become your work!