[Editor’s Note: This is a guest post by Matthias Machowinski, Directing Analyst, Enterprise Networks and Video at Infonetics.]

Infonetics recently published our Enterprise Networking and Communication Vendor Leadership Scorecard, our annual look at the top vendors in this space and their strengths and weaknesses. Enterprise networking and communication infrastructure is a critical component of the day-to-day operations of any organization—it connects people, devices, and IT systems and allows them to communicate with each other securely. This market consists of 3 major sub-segments:

- Networking: Equipment used to build enterprise networks, such as switches, routers, and WLAN

- Communication: Equipment and software that provides real-time enterprise voice and video communication, such as IP PBX, videoconferencing rooms, and UC software

- Security: Products that provide security for networks and network-connected devices, such as firewalls, IDS/IPS, and content security appliances

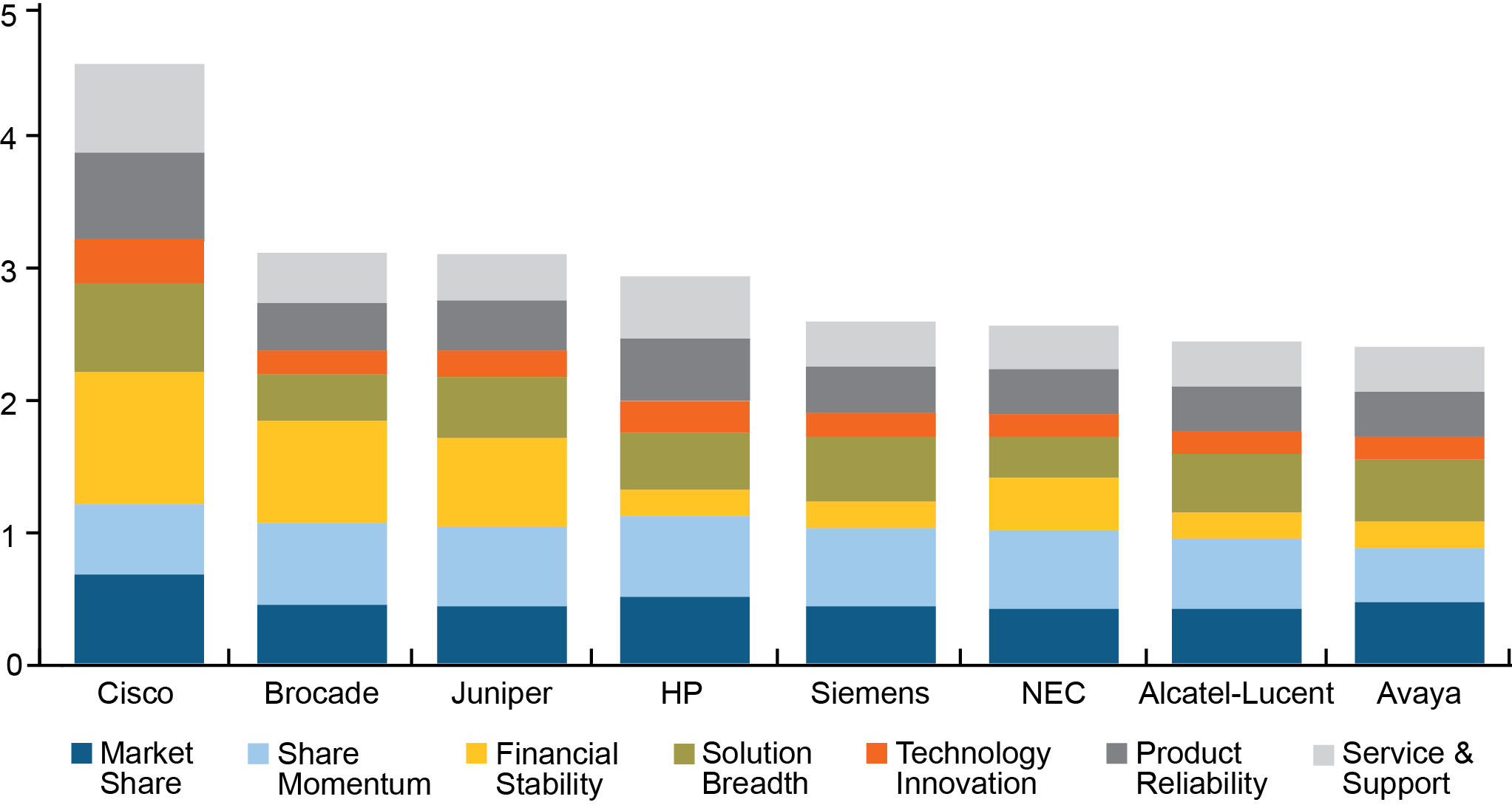

Well over 100 vendors vie for a piece of this $50B market, but only a dozen capture more than 1% market share each. We evaluated the 8 largest vendors with diversified product offerings—Alcatel-Lucent, Avaya, Brocade, Cisco, Juniper, HP, NEC, and Siemens—using important vendor selection criteria and markers of success, including:

- Service and support

- Product reliability

- Technology innovation

- Solution breadth

- Financial stability

- Market share

- Market share momentum

To eliminate subjective scoring, we used a data-driven model that incorporates actual vendor performance and direct feedback from buyers to objectively determine vendors’ positions in the marketplace. So what did we find?

Top Enterprise Networking and Communication Equipment Vendors: Overall Scores

Our evaluation showed that Cisco has the highest score overall, capturing perfect or near-perfect scores in 6 of the 7 criteria. Cisco doesn’t have much room to grow its overall score but still managed to do so since our previous evaluation last year, thanks to improving market share momentum. Specifically, we found that:

- Cisco is the only vendor in our scorecard to offer products in all enterprise networking and communication segments, which gives Cisco the capability to offer highly integrated solutions across multiple IT and networking needs.

- Cisco is one of the top global brands and has very strong brand recognition. In the thousands of end-user interviews we’ve conducted over the years, Cisco consistently makes it to the top of buyers’ short lists and gets strong marks on top purchase criteria such as product reliability and service/support. The common refrain from buyers is that they love Cisco, and the only thing they would love even more is paying a little less. But that usually doesn’t stop them from purchasing Cisco gear.

- Cisco has extremely sound financials, giving Cisco multiple ways to invest in its business and weather financial distress, should it ever strike.

- Cisco has the highest market share, capturing ~45% of total enterprise networking and communication revenue in calendar year 2012, due to strong execution and the breadth of its product portfolio.

- Cisco’s only weakness is its market share momentum, where it comes in 6th place—actually an improvement over last place the previous year. Given Cisco’s very high level of market share (~45% of revenue), it’s simply mathematically challenging to gain much more share but fairly easy to lose it; thus, Cisco is likely to always struggle on market share momentum.

To see the full results of our research, download your free copy of Enterprise Networking and Communication Vendor Leadership Scorecard.

CONNECT WITH US