“Let the buyer beware” is a sentiment that dates back well before consumer protection and truth-in-advertising laws. Yet, the issue of trust continues to permeate all areas of society today. A few weeks ago, I wrote about the “trust cliff” that affects the amount of information consumers are willing to share with retailers in order to have more relevant interactions.

Now, a new Cisco study on retail banking in 12 countries reveals a different kind of trust problem: consumers are getting less value than they expect from their banks, and this “value gap” is impacting customer trust.

The global financial crisis of 2007-2008 greatly damaged consumer trust in financial institutions, and brand equity has fallen along with it. In 2009, one year after the financial crisis, the world’s top 500 brands saw the value of their brands drop by 32 percent. For many banks, their brand value has yet to recover from pre-crisis levels.

But the roots of distrust go deeper than that. Our study shows that there is a fundamental disconnect between banks and their customers, and many customers no longer look to their banks to help them meet their financial goals. In fact:

- 43 percent of customers say their bank doesn’t understand their needs

- One in four would choose another provider for their next account or service

- Only 40 percent of respondents worldwide turn to a financial professional for advice, and of these, 28 percent believe the advice is ineffective

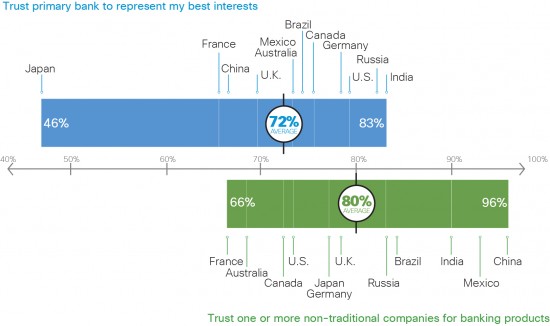

Meanwhile, a growing cadre of disruptive “non-bank” innovators is exploiting this value gap between banks and their customers. They range from technology companies such as Apple and Google, to retailers such as Amazon.com and Tesco, to mobile and digital-only banking services, payment companies, and automated investment services. A surprising 80 percent of consumers surveyed said they would trust a non-bank for their banking services. In eight out of the 12 countries surveyed, more consumers would actually trust a non-bank than their own bank.

On one hand, this paints a precarious picture for today’s retail banks. On the other hand, banks now have the opportunity to reassert their role as trusted advisors by delivering financial guidance and other high-value services—but this time, enabled by the Internet of Everything (IoE).

Cisco Consulting Services asked consumers about their interest in a number of IoE-enabled banking concepts—especially focused on the areas of advice and mobile services—that could be part of a new “digital bank” experience.

Consumers expressed tremendous interest in these concepts. In fact, 75 percent of global consumers said they would move their money to a different institution in order to access one or more of these advice or mobility concepts.

By innovating with the customer at the center, a fully digitized bank can leverage its expertise and customer data to develop relevant, actionable customer insights.

But implementing a set of stand-alone IoE-enabled banking services will not be enough to close the value gap. First, banks will need to fully digitize their business processes with the customer at the center. Banks have already improved efficiency through digital technology. Now they need to invest in the video, mobility, and analytics capabilities that will enable them to deliver the contextual guidance and interactions that customers value. If they do, our economic analysis shows that they could add up to 15.2 percent to their bottom-line profit before taxes.

Cisco’s new campaign on the “Museum of Lasts” shows all the frustrating experiences that can be made relics of the past by the networked connection of people, process, data, and things—the “last traffic jam,” “the last missed meeting,” “the last checkout line.” One day, with the vast ability of IoE to enable timely, contextual, and valuable interactions, perhaps we can add “last lost bank customer” to the list.

Sounds quite intriguing but what really is the Cisco offering (IOE) in this context and how is it positioned to add value and inevitably create an environment of more trust in the banking industry?

agree with you

~http://homeyard99.blogspot.com/

Great corelation displayed betwen the branding promise and the trust implicit therewith. It assumes greater importance seeing that 80% revenue of an organisation is generated from its existing customers and not new ones. The existing customers come back on account of trust. Great read and ofcourse painfully relevant to the banking industry especially given th recent tumultous times that have shaken the customer confidence in this industry.

Great read and ofcourse painfully relevant to the banking industry especially given th recent tumultous times that have shaken the customer